👍 Filter by supported exchanges, wallets, DeFi or NFT tx support;

👍 Search by TurboTax or TaxAct integration or supported countries;

👍 Check Tax-loss Harvesting or Portfolio Tracking tools;

👍 Get special discounts on crypto tax software.

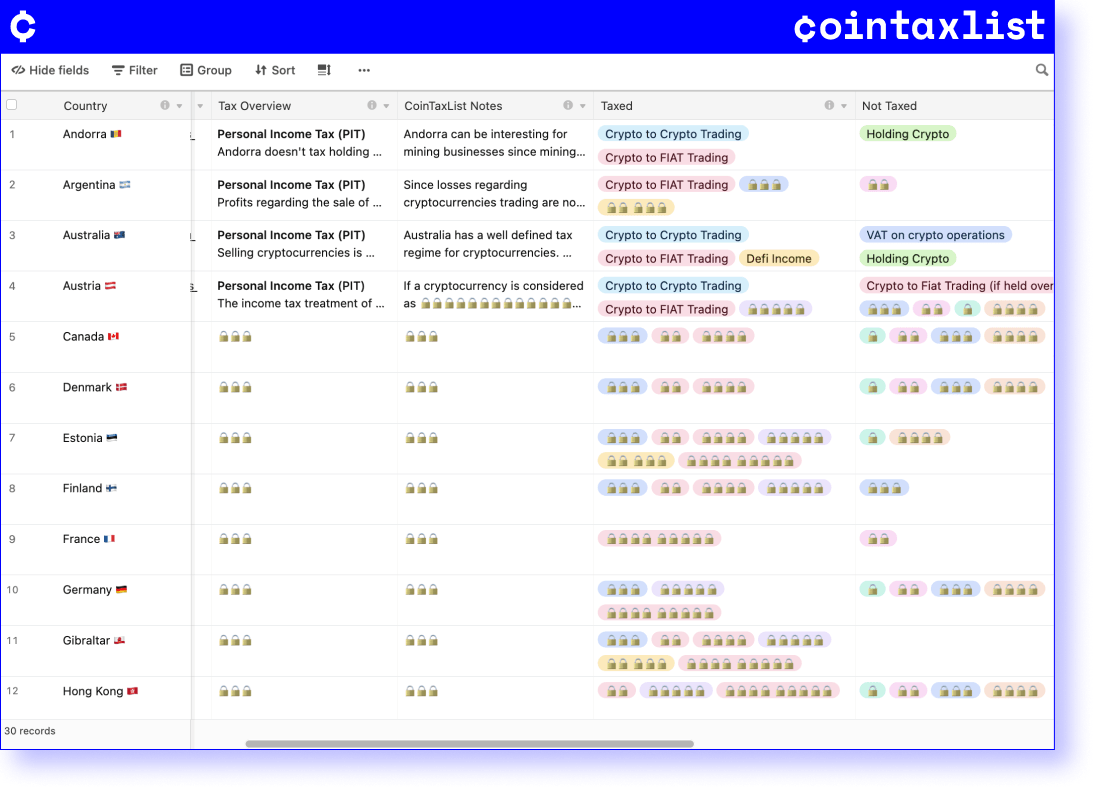

Get access to Cointaxlist's research on crypto taxes of 30 countries:

👍 Existing crypto Tax Authorities official guidance;

👍 Tax Authorities official links;

👍 Tax overview of crypto income.

Join our email list for crypto tax updates & insights.