In the last months Non-Fungible Tokens (NFT) have taken the world by storm, especially in digital art and collectibles’ space.

There are amazing stories on this space. Beeple, an NFT Creator, made a record sale of his “Everydays: The First 5000 Days” NFT on first-of-its-kind auction at Christie’s for $69 million. Tom Osman, an NFT Investor, invested 1,7 ETH in an NFT project called EtherRock and sold it 19 days after for 400 ETH (more than $1 Million dollars at current rates).

If you want to have a good picture of how much volume the NFT market is moving, check these stats.

What are NFTs?

NFT stands for non-fungible-token, which basically means that it represents a unique digital item on a blockchain. Non-fungible means that you can’t exchange one of its units with another and necessarily have the same value (on the opposite, US Dollars are fungible).

NFT can be lots of things (a ticket to a show, a digital art image, a video), but the latest frenzy is about NFT that are collectibles or that represent digital art.

NFT are available in several blockchains, being the NFT traded in the Ethereum blockchain the ones that are more popular and that drive most of the volume of the market.

Some of the most popular marketplaces to trade NFT’s are Opensea, Rarible or SuperRare. You can also search for NFT's before they launch on marketplaces in platforms such as SeaLaunch.

Are NFTs taxable? And when do you have to pay NFT taxes?

Please note, this article is written from a US taxation perspective and essentially focus NFT taxation associated with trading NFTs, in simpler terms purchasing or selling NFT digital art and collectibles.

Despite their unique and indivisible nature, all digital assets, including NFTs, are regarded as “property” for tax purposes under IRS Notice 2014-21.

Before entering into more details on if NFTs are taxable or how NFT sales are taxed, it should be noted that NFT taxes depend on specific situations.

In general, there are two ways you can interact with an NFT:

1) You can create (mint) and sell an NFT (NFT Creators);

2) You can buy and sell NFT from other creators (NFT Investors)

NFT taxes for NFT Creators

Is selling an NFT a taxable event?

Although minting (creating) an NFT is not considered a taxable event, when an NFT Creator sells an NFT (in a marketplace like Opensea) the revenue generated by the sale is subject to income tax.

As an NFT Creator, the revenue that you get from an NFT sale is considered ordinary income and will be taxed accordingly.

As of 2021, ordinary income tax rate varies from 10% to 37%. Also, this income is subject to self-employment taxes, at a rate of 15,3%.

If an NFT Creator sells an NFT as a trade or business, business expenses are deductible for tax purposes.

Secondary sales of the NFT

Revenue earned by secondary sales (if the creator earns a percentage of all the subsequent sales of the NFT) is also considered ordinary income and is taxed as previously described.

How to report NFT Creators taxes

NFT Creators income is reported on Schedule C (Profit or Loss From Business) or on the applicable business tax return (Form 1120, 1120S or Form 1065).

NFT Creators can deduct business expenses (such as auction fees, transaction fees etc) under Section 162.

NFT taxes for Investors

Do you pay taxes for buying an NFT?

For NFT Investors, NFT taxes are similar to those applied to cryptocurrency trading.

In this sense, when an NFT Investors trades an NFT for other cryptocurrency, this is considered a disposal of the cryptocurrency and will give rise to a capital gain or loss.

If the cryptocurrency used to buy the NFT (typically ETH) values more than when it was bought, depending on how long the token used to buy the NFT is held, the NFT investor is subject to either the long term or short term capital gains tax rate.

On the other hand, if the cryptocurrency used to buy the NFT is less valuable than when it was bought, the NFT Investor would incur a capital loss and could use this to offset other capital gains and reduce the overall tax burden.

If the cryptocurrency used to buy the NFT is held for less than 12 months short-term capital gains tax rate is applicable. These tax rates are similar to ordinary income tax rates and can be up to 37%, depending on the personal income tax bracket.

If the cryptocurrency used to buy the NFT is held for more than 12 months, long-term capital gains rate applies (that varies from 0 - 20%).

Selling an NFT

Selling an NFT is considered a taxable event (either if it is sold by a cryptocurrency or traded with other NFT), and will give rise to a capital gain or loss.

As previously described, the tax rate would vary taking into account the holding period of the NFT (more or less than 12 months).

Additionally, it should be noted that NFT may be considered collectibles under Code 408(m) (which applies to works of art, antiques, stamps or coins etc). This would give rise rise to taxation at a tax rate (28%) that may be higher that the one used for long term capital gains (specially for high-net-worth individuals).

How to report NFT taxes for Investors

NFT Investors can use Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses) to report the disposal of cryptocurrency to purchase NFTs and the subsequent sale of NFTs. Please note that the sale of a collectible must be indicated with the code “C” on Form 8949 column (f).

Crypto Tax Software for NFT tax reporting

Since purchasing and selling on NFTs are taxable events and your NFT sales profits might be subject to capital gains taxes consider using a crypto tax software to keep a record of all your NFT transactions before filling your tax reports.

There are a number of Crypto Tax Calculators or Software that can help you keep track and calculate your NFT taxes. For example, Cointracker officially partnered with OpenSea to simplify NFT taxes. But, we've made a short list of top Crypto Tax Software that support NFT tax reporting (many have TurboTax or TaxAct integrations).

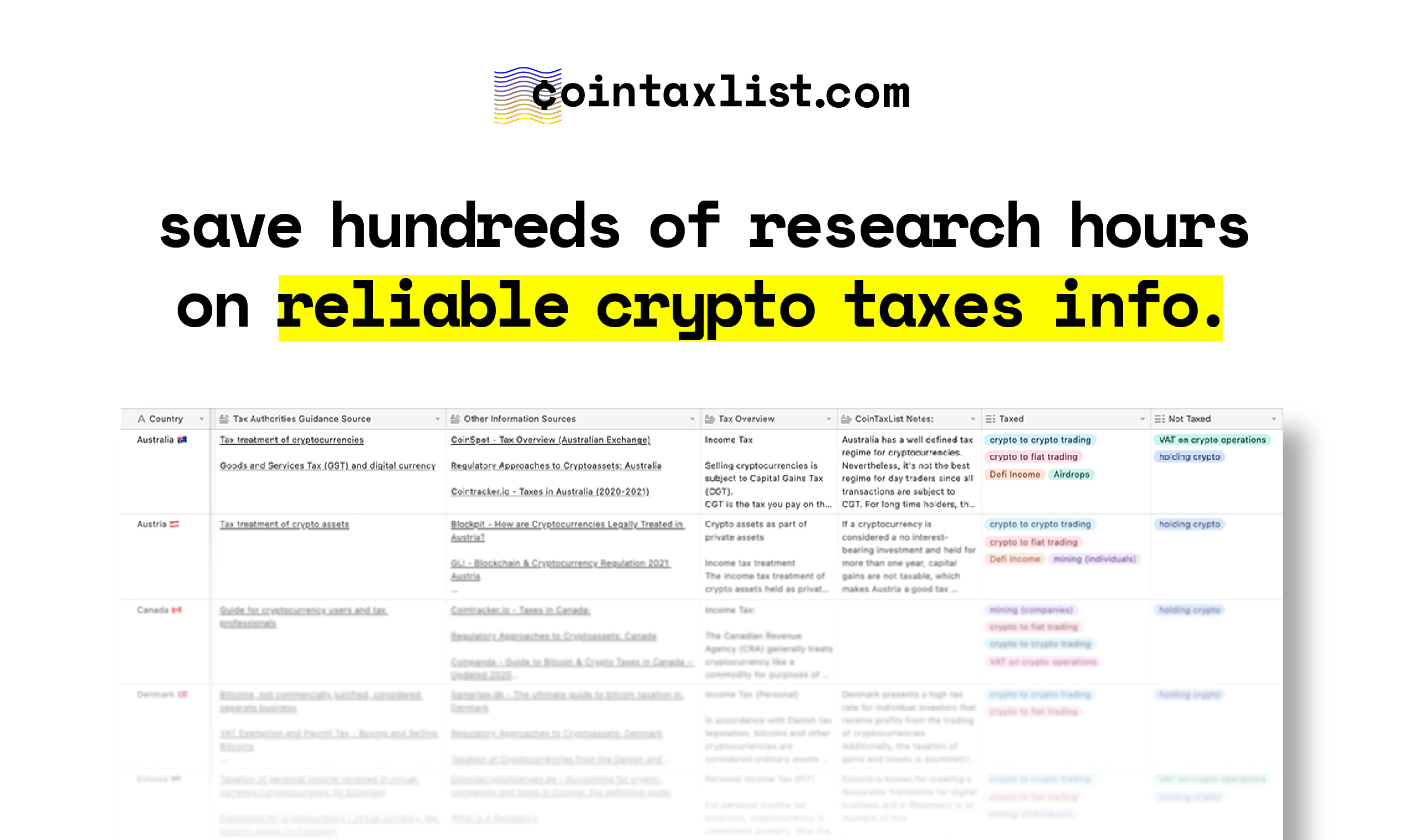

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.