If you ever come across an article comparing the most crypto tax friendly countries (like this, this, or this), you have noticed that Portugal is almost always in the top 10 and is even considered a crypto tax haven by some.

Plus having such good weather, a relatively low cost of living and a safe environment had already made this destination a favorite between digital nomads, even surpassing Bali.

Additionally, Portugal also offers a very attractive Non-Habitual Resident regime, applicable to the foreign income of individuals, designed for people wishing to transfer their residence to Portugal.

Should I relocate to Portugal with my cryptocurrencies to benefit from its tax regime?

Firstly, for individuals investing in cryptocurrencies that are tax residents in Portugal it should be noted that currently, the Portuguese Tax Law doesn’t foresee specific regulation regarding cryptocurrencies.

Nevertheless, the Portuguese Tax Authorities (PTA) have published their position (written in Portuguese) regarding the taxation of cryptocurrencies in a binding information.

Before entering into detail of what is the PTA position regarding this matter, it should be noted that this position only gives a framework about individual taxation and can change in the future i) if the PTA changes its opinion or ii) if the law changes.

In the binding rule published, the PTA considers that capital gains resulting from the sale of cryptocurrencies will not be taxable (crypto to fiat, as well as crypto to crypto) under the Personal Income Tax Code, within the scope of category E (dividend and interest income), nor subject to being taxed under category G (as capital gain).

Additionally, the PTA considers that the profits obtained from the sale of cryptocurrencies are only taxed at a personal level if their regularity ends up constituting a professional or entrepreneurial activity of the taxpayer, in which case it will be taxed as a qualifying income under the category B (freelancing) of the Personal Income Tax Code.

In short, the PTA considers that capital gains resulting from the sale of cryptocurrencies are not subject to Personal Income Tax unless it is considered that this activity is a professional or entrepreneurial activity of the taxpayer.What is the criteria for the definition of what constitutes a professional activity from a tax point of view?

Well, the criteria for the definition of what constitutes a professional activity from a tax point of view are not clearly defined by Portuguese law and depend of the PTA analysis but some common criteria that may indicate that its considered a professional activity are:

- high regularity of the activity,

- high economic dependence (in relation to other income),

- physical space for the activity and workers.

The fact that one of the factors applies does not mean that you are automatically a professional trader and this should be analysed on a case by case basis.

How can I be certain of what will be the PTA position regarding my situation?

To avoid uncertainty on decisions, taxpayers in Portugal (or non residents that wish to relocate) can request a binding ruling from the Portuguese tax authorities regarding the application of any tax rule or regime to a certain operation to be performed.

The binding ruling must be issued by the PTA within 150 days (75 days for urgent rulings).

Once the binding ruling is issued, the PTA cannot act differently with respect to the subject matter of the ruling, unless otherwise required by a judicial decision.

The ruling ceases to be binding after four years (unless a renewal is requested), and after the first year it can be revoked without retroactive effects.

If you are interested in help with the preparation of this, let us know here.

Will the Portuguese Tax law change in the near future in respect to the taxation of cryptocurrencies and how would this affect me if I relocated before it changes?

As far as we know, there isn’t any indication for now that there is a legislative process underway to introduce taxation to cryptocurrencies in Portugal and there isn’t also a public discussion regarding this matter.

Nevertheless, this does not mean that the Portuguese government will not introduce a law regarding this matter either to tax cryptocurrencies or to clarify that cryptocurrencies are not subject to tax.

If the Portuguese government approves a law that taxes cryptocurrencies, the specific of how this will affect the taxpayer will depend on how the law is designed, nevertheless taxpayers should be aware that there are ways to minimize the tax exposure before this situation happens.

Keeping a record of crypto transactions

Even if you end up not paying taxes related to crypto income in Portugal, it is advisable that you keep a personal record of all your crypto related transactions.

You want to be able to prove when you sold a digital asset and that there wasn’t tax due on that transaction at that time.

Also, the Anti Money Laundering (AML) rules have been more strict in the last years (and it is expected that the regulation related to crypto increases in the EU), so you may also be requested by the financial institution you use the origin of the funds for AML purposes.

The easiest way to keep a record of all your transactions and create AML reports is using a crypto tax software. There are some options available on the market, so we created a Crypto Tax Software Comparison tool, to help you find the right tool for your situation (taking into account the exchanges you use, how many crypto transactions you do per year and other variables).

Are you considering relocating to Portugal?

If you are considering relocating to Portugal take a look at our article explaining how Portugal is becoming more a crypto hub than a crypto tax haven.

Additionally, if you would like to understand the best way to make this move, especially taking into account the tax implications of the crypto income, we can help you.

Schedule an exploratory call with us, where we do a high-level evaluation of your situation to help you choose what routes make more sense to explore and answer any question that you may have. Book exploratory call here.

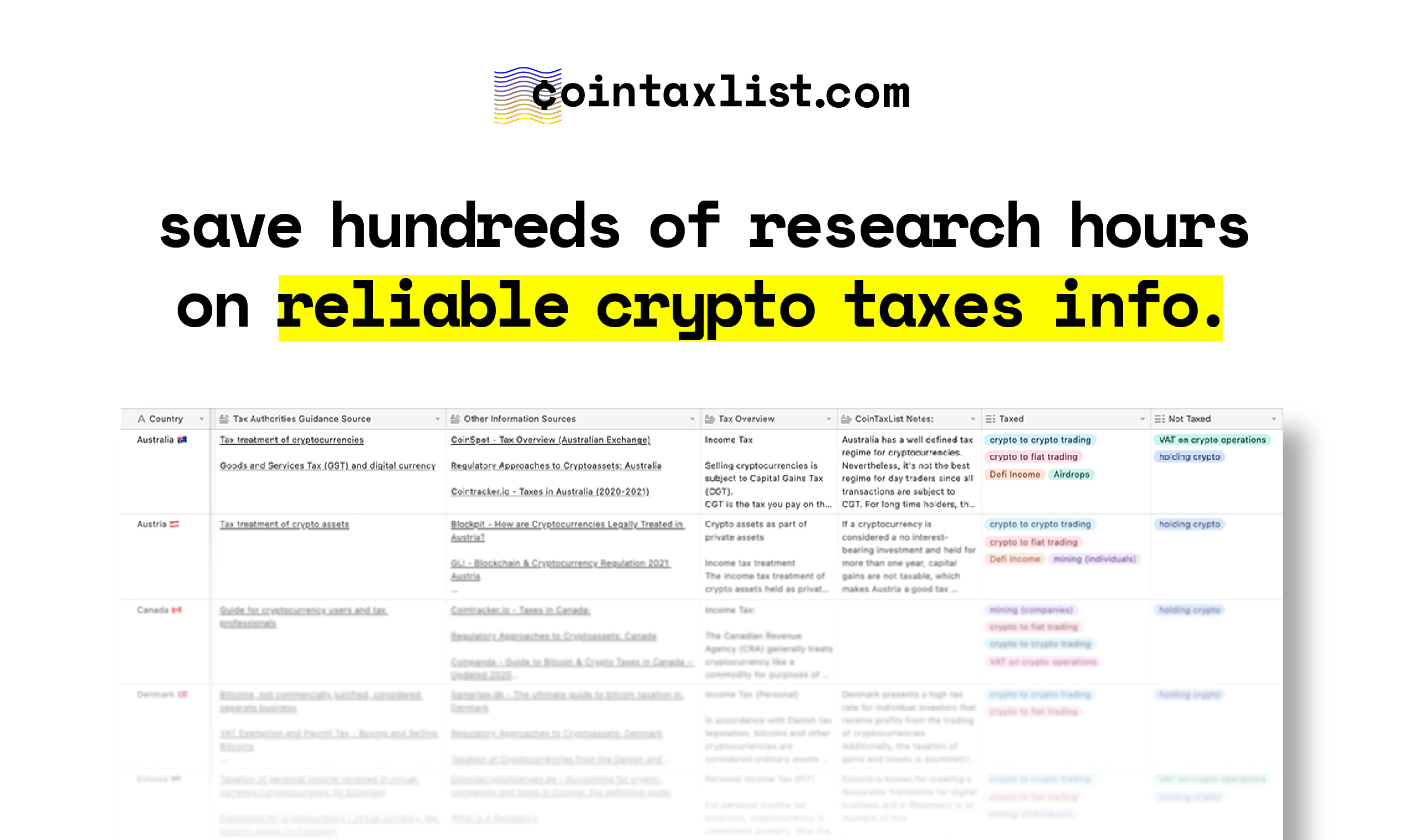

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.