Remote work has been on the rise in recent years, but the pandemic made it the new standard and in some (hybrid) form or another is here to stay.

As a result, this trend changed how companies hire and digital nomads want to find the best places to live and work remotely as a location independent remote worker.

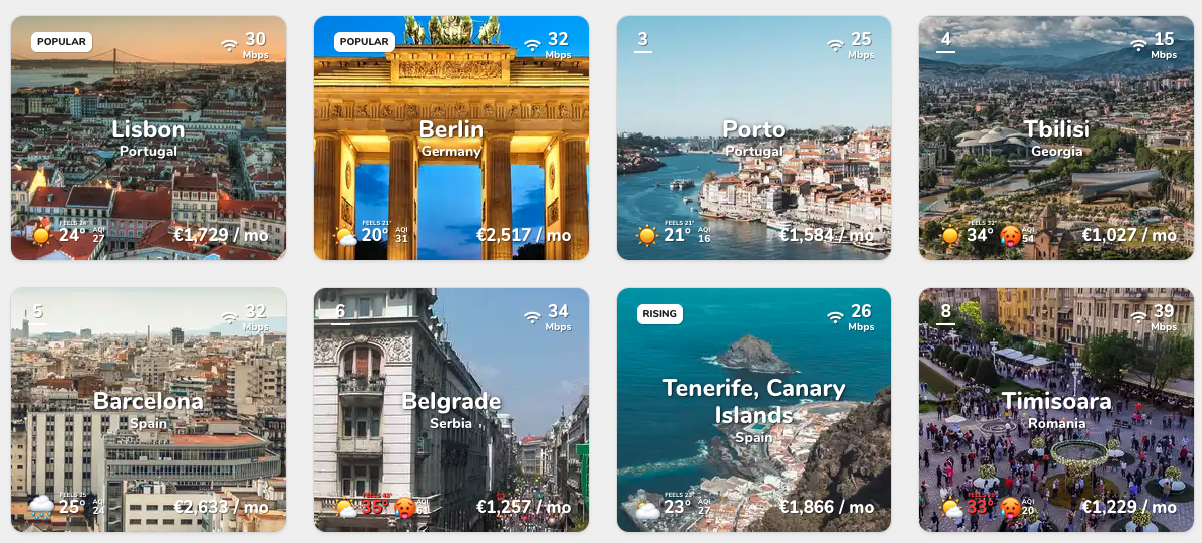

If you check Nomad List's most popular cities in Europe, they are located in Portugal, Germany, Georgia, Spain, Serbia and Romania.

Cost of living, Internet speed, good weather, social activities and safety are among the most important factors, but what about "crypto tax friendly"?

Portugal

Portugal is normally considered as crypto friendly country from a tax point of view, because the Portuguese Tax Authorities considers that income resulting from the sale of cryptocurrencies is not subject to Personal Income Tax unless it is considered that this activity is a professional or entrepreneurial activity of the taxpayer.

There are quite a few nuances on this because the criteria for the definition of what constitutes a professional activity from a tax point of view is not clearly defined by Portuguese law and depends of the tax authorities analysis.

Although current tax framework makes Portugal a crypto tax friendly country from a personal income tax standpoint, there is still a level of uncertainty for the foreseen future.

It is expected that in the future the Portuguese Tax Law introduces a specific tax regime for cryptocurrencies which may give rise or not to taxation. There has been some rumours on Portuguese media that a bill could be introduce to tax cryptocurrencies during crypto hype cycle, nevertheless, currently, there isn't any evidence that there is a legislative process going on.

In the meantime, make sure you fulfil all the conditions to not pay taxes on your crypto at a personal level if you are a Portuguese Tax resident.

Germany

Profits regarding cryptocurrencies are tax-free if the total profit generated from private sales transactions in the calendar year was less than 600 Euros.

Additionally, the sale of cryptocurrencies that were held for over a year and the, do not give rise to taxation.

In short, Germany has a very attractive tax regime for long term (more than a year) individual investments in cryptocurrencies or if the annual profit is small (under 600 euros), since these are tax exempt.

Spain

At a personal level, capital gains from the sale of cryptocurrencies are taxed in Spain in a range of 19% - 23% (based on income).

If the cryptocurrencies are purchased and sold within a 12 months timeframe, the tax rate can vary between 24.75% and 52%.

Additionally, losses with cryptocurrencies trading are deductible to the capital gains (in the same year or in the subsequent 4 years).

TL;DR between Portugal, Germany and Spain, what is the most crypto tax friendly country?

Well, overall Spain loses this battle because Spanish tax rates are higher than the other two countries.

Both Portugal and Germany offer no taxation on cryptocurrencies, but with different conditions.

In Portugal the conditions depend of your particular situation (that you are not considered a "Professional trader") and in Germany the conditions are related with the transaction itself (less than 600Euro and/or held for more than a year).

Taking into account the uncertainty regarding Portuguese tax framework (only based on the position of the Portuguese Tax Authorities which may change and expected future changes in the law), Germany offers the less risky way to get 0% taxes on cryptocurrencies.Nevertheless, if you are already in Portugal, make sure you can take advantage of the low crypto taxation.

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

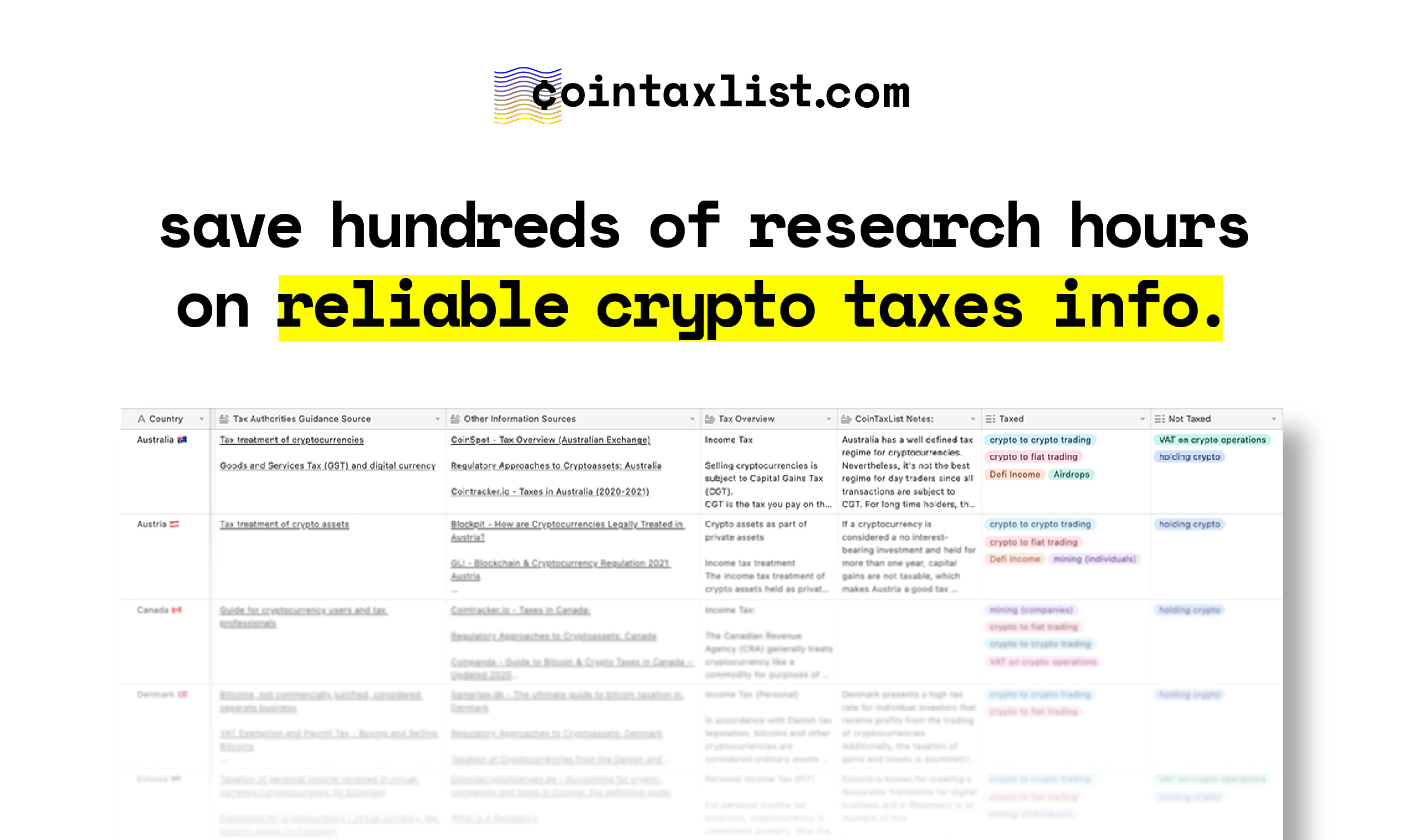

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.