Germany has hit the headlines as an attractive crypto friendly country for individuals to invest in cryptocurrencies, let's understand why.

First of all, please note that the German Federal Central Tax Office considers cryptocurrencies as private money for tax purposes. In this sense, cryptocurrencies are not considered as a legal tender, foreign currency nor as property.

How much tax do you pay on crypto in Germany?

At a personal level, profits regarding cryptocurrencies are tax-free if the total profit generated from private sales transactions in the calendar year was less than 600 Euros and sales of cryptocurrencies held over a year are tax exempt in Germany.

This makes it a very attractive regime for individuals (0% tax rate), specially for long term hodlers.

When do you have to pay tax on crypto gains?

Note that if at least one of these conditions is not met (holding over a year or sale under 600 Euros), the income arising from the sale of cryptocurrencies are subject to income tax over the net amount gained or lost at the time of the sale.

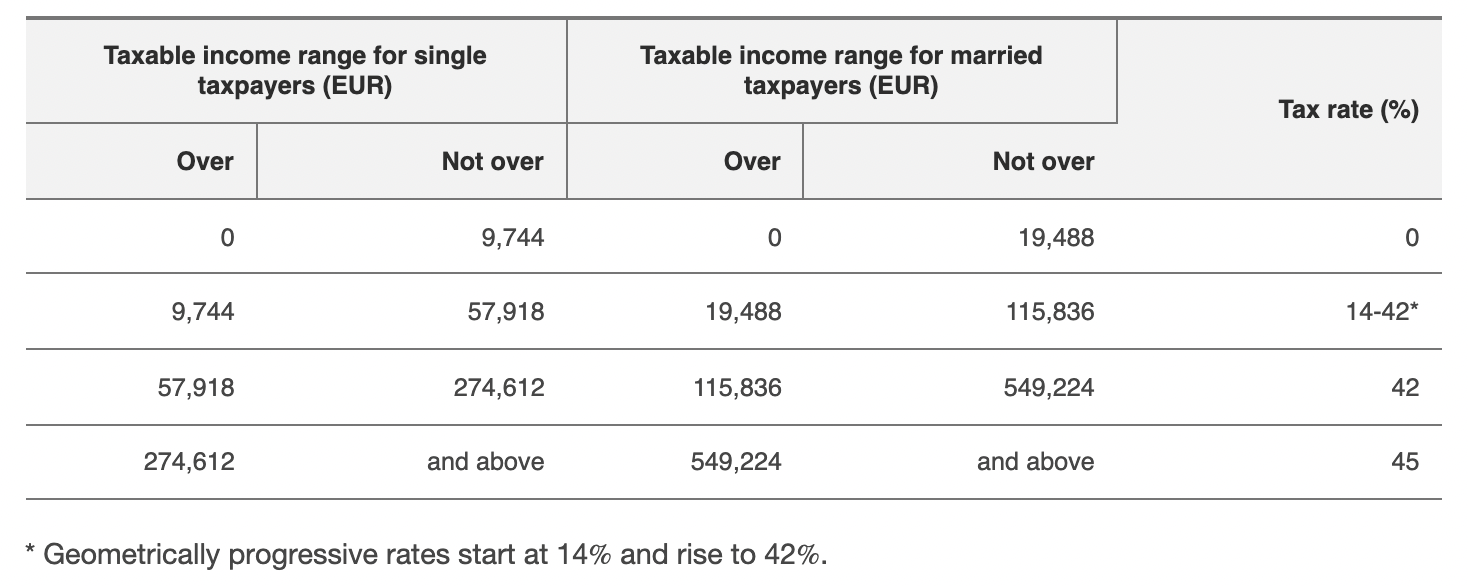

This income is subject to Personal Income Tax, which has progressive income tax rates ranging as follows (for 2021 tax year):

Additionally, crypto to crypto and crypto to fiat sales are taxable under German tax law, however crypto fees paid are deductible for tax purposes.

Is Bitcoin taxed in Germany?

For example: in what regards income arising from mining bitcoin, this is taxed as other income under German tax law. The taxable amounts are the net profit on the cryptocurrency (i.e. the revenue from mining deducted from the costs associated such as energy).

Crypto taxes calculators or software to help calculate German Crypto Taxes

A useful resource to calculate and report your German crypto taxes is using a crypto tax calculator. There are some options available on the market, so we created a Crypto Tax Software Comparison tool for software that include Germany, to help you find the right tool for your situation, some examples below:

- To calculate crypto taxes if use a popular exchange like Coinbase, Binance, Crypto.com or if you use multiple exchanges (CEX or DEX);

- To calculate your taxes on your Bitcoin, Ethereum and other crypto gains;

- How many crypto transactions you do per year.

Since crypto tax reporting is still in its early days, a crypto tax software may also be a useful tool to provide reports to your accountant to help in the crypto tax reporting process (since at this stage most accountants are not familiar with the crypto world).

In conclusion

Germany has a very attractive tax regime for long term (held over a year) individual investments in cryptocurrencies or for small yearly profits (below 600Euro), since these are tax exempt.

Nevertheless, this doesn't mean that Germany is a tax haven for crypto, since other types of income may be subject to tax.

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.