Buying and selling cryptocurrencies, receiving airdrops, minting an NFT, purchasing or selling an NFT, receiving income from DeFi are just some examples of what can be considered a cryptocurrency related taxable event.

In the last few years, there has been a complexification of the rules for accessing crypto taxes (especially in the US and UK, but it is expected that most countries will follow this route). Plus, if you use several exchanges for dealing with crypto, do a high number of transactions per year and/or have different types of crypto income, calculating your tax bill can be a challenge.

Also, the current number of accountants/CPAs familiar with crypto is very limited, so finding an accountant/CPA that can help you with your crypto taxes can be hard.

Crypto tax calculators or software facilitate tax reporting and tracking transactions across multiple platforms for those dealing with cryptocurrencies, earning DeFi interests, trading digital assets or minting digital art.

Why you should use a cryptocurrency tax software or calculator?

It saves time and reduces the complexity of reporting your crypto related taxes (although it can still be a challenge). We will outline some of the reasons you should consider using crypto tax software and how they can be helpful.

Keep a record of transactions for tax purposes

Regardless if you use centralized or decentralized exchanges, each platform reports transactions in different formats. You’ll need these transactions’ records to be compiled and organized for i) tax reporting purposes, ii) to fulfill anti-money laundering regulation or iii) for compliance reasons when dealing with traditional banks.

Crypto tax calculators helps you to standardize and aggregate your portfolio’s data across multiple platforms so that you can calculate your taxes.

In addition, many of these, provide crypto dashboards, customer support and crypto portfolio trackers as part of their offer, giving you the possibility of a global view of your crypto assets.

Tax-loss harvesting to reduce the crypto tax burden

Tax-loss harvesting is a tax strategy to reduce the tax burden. In simple terms, crypto tax-loss harvesting consists of analyzing the potential tax losses of each asset and selling a certain asset to create a capital loss to offset against capital gains.

Some of these software provide crypto tax-loss harvesting tools that help you understand the unrealized gains/losses of each cryptocurrency, NFT or other digital asset you own so that you can strategically sell those that have unrealized losses and therefore reduce your tax burden.

Calculate your crypto taxes

Crypto Tax calculators or software simplify the calculation of your capital gains related to cryptocurrencies.

For US tax residents, many of these software are integrated with US tax reporting tools (e.g: TurboTax Integration) or can produce US tax compliant forms. For other countries, software can help you create a crypto tax report that complies with your country’s specific rules.

Even in more complex situations where a crypto tax advisor is required, these software can still be useful to gather all the information needed for the specialist analysis.

If you are worried about data privacy, some of the software allows you to import csvs directly and not connect this data to you.

Find the best cryptocurrency tax software for your needs

There are a number of software on the market to choose from. To find the best crypto tax calculator or software for your situation, you should take into account the following features:

- Country reports compatibility;

- Number of transactions limit;

- Exchanges, Wallets and blockchains compatibility;

- Other features, such as tax-loss harvesting tool, portfolio tracking, DeFi/NFT support;

- Pricing.

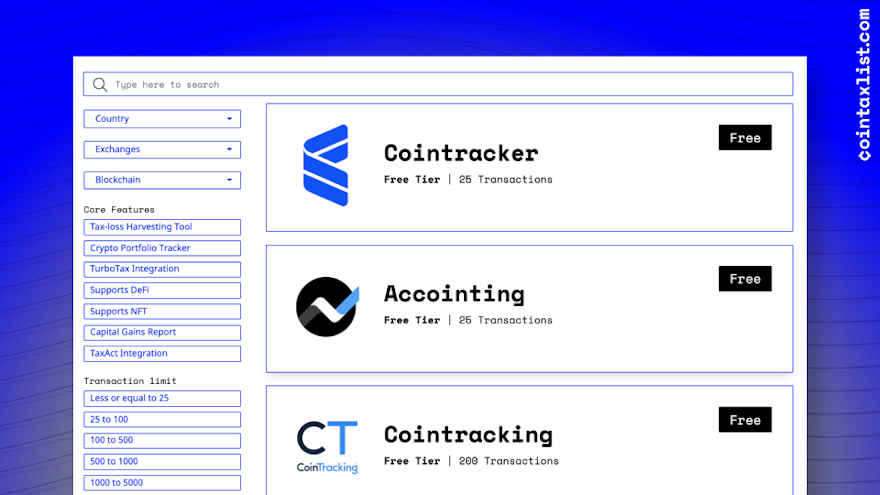

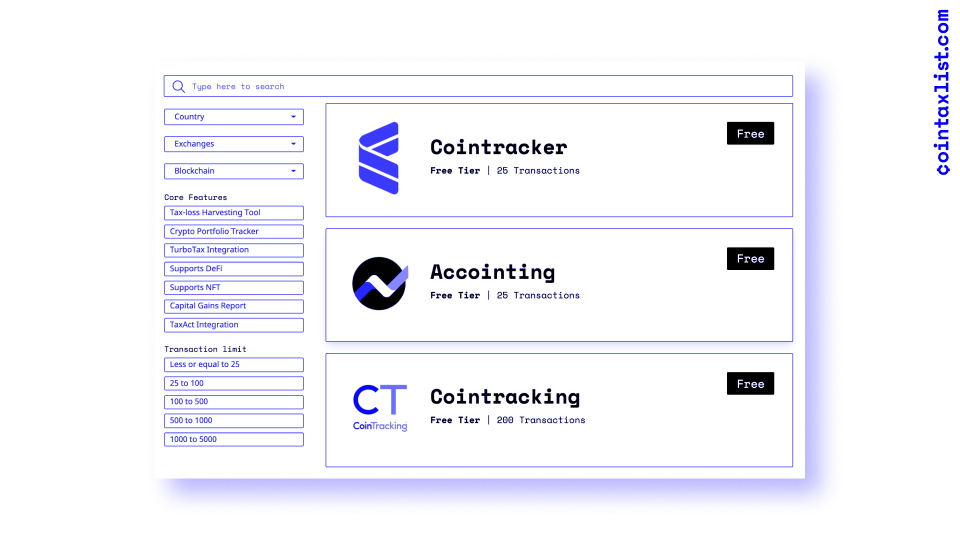

To make this choice easier, we’ve built a free and simple Crypto Tax Software Comparison Tool to help you compare the available crypto tax software and find the right tool for your specific crypto situation.

Use our crypto tax software comparison tool's filters to find the best solution:

📊 Transaction Limit;

⚖️ Crypto Exchanges, Wallets or Blockchains supported;

📉 Tax-loss Harvesting Tool;

🔗 TurboTax or TaxAct integrations;

📈 Defi or NFT support;

🗺 Supported country;

There are also some special discounts available on some of the software for CoinTaxList’s subscribers!

Try Crypto Tax Software Comparison Tool here!

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

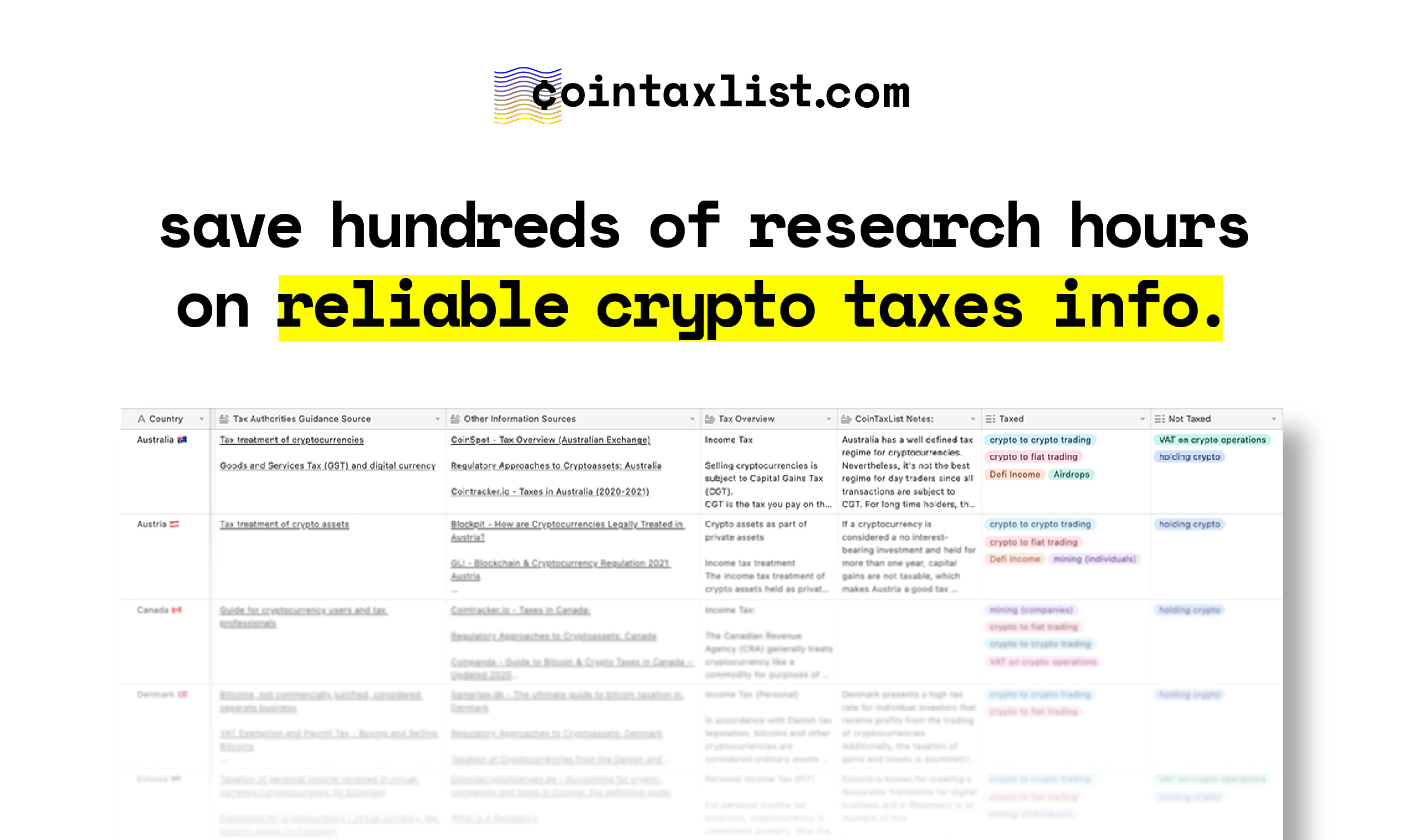

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.