In May 2022, Portugal witnessed the country’s first real estate transactions using cryptocurrency as payment.

In the past, companies acted as intermediaries to facilitate real estate transactions, but this wasn’t the case this time.

This was the first public registered real estate transaction using crypto directly as payment (the house cost was 3 Bitcoin).

In the last months, Portugal saw an increase in the demand for real estate crypto transactions and, for this reason, there was a high number of requests for clarification by notaries and lawyers to the Portuguese Notary Association.

In this context, the Portuguese Notary Association decided to clarify how these transactions should be considered for legal purposes and what documentation should be required to pursue them.

The Portuguese Notary Association considers that this type of transaction is similar to other types of barter deals (“contrato de permuta” in Portuguese) that are allowed by current law (for example, exchanging a car for a house).

In this context, no legal barrier should exist for pursuing this type of transactions (and others that may be possible according to current law such as increasing a company capital with cryptocurrencies).

What’s the procedure for buying a house with cryptocurrencies?

As previously mentioned, this real estate deal would be a barter deal (“contrato de permuta”) exchanging a real estate property for a digital asset (cryptocurrency).

In these cases, five days prior to the real estate transaction using digital assets (cryptocurrency) as the payment asset, some information should provided to the notary that intermediates the deal, namely:

identification of the buyer and the seller,

identification of the price (in fiat and crypto) agreed for the transaction,

identification of the digital asset used in the transaction,

proof of the origin of the funds (since its acquisition until the moment of the deal),

wallet addresses used in the transaction.

At this stage and since there aren’t many transactions yet, it is not clear what’s the depth of the information required to prove the origin of the funds in terms of wallet transactions. This can also be a problem in a situation where the funds were originally bought in exchanges that do not exist nowadays.

Prior to the transaction, the notary should provide this information to specific divisions of the entities responsible for overseeing anti-money laundering rules in Portugal: i) Public Prosecutor and ii) Criminal Police (in Portuguese: i) Departamento Central de Investigação e Acção Penal do Ministério Público and ii) Unidade de Informação Financeira da Polícia Judiciária).

If the amount of the transaction exceeds €200.000, this information should also be provided to the above mentioned entities after the transaction.

What if the cryptocurrencies are converted into fiat before the deal?

If the transaction takes place using cryptocurrencies that are converted into fiat (Euros, for example) before the transaction, then the process follows the normal procedures for real estate transactions.

This type of real estate transaction has been concluded in the past and is more standard.

In this situation, the responsibility for preventing money laundering is divided between several parties (banks, crypto exchanges and notaries).

In this case, the money will come from a bank account that was previously converted and transferred from a crypto exchange firm. These two entities will have already adopted anti-money laundering procedures to avoid risks about the origin of the money when the money was transfered.

Conclusion

Overall, a real estate transaction directly using digital assets (cryptocurrencies) as payment is possible in Portugal under current law framework. Nevertheless, it should be noted that the bureaucracy around these transactions is higher than a real estate transaction paying with fiat (or converting crypto to pay with fiat).

Also, information about the origin of the funds should be provided prior to the transaction to guarantee that anti-money laundering rules are fulfilled. Normally, this type of information is provided by the financial institutions involved in a transaction and not directly by the owner of the assets.

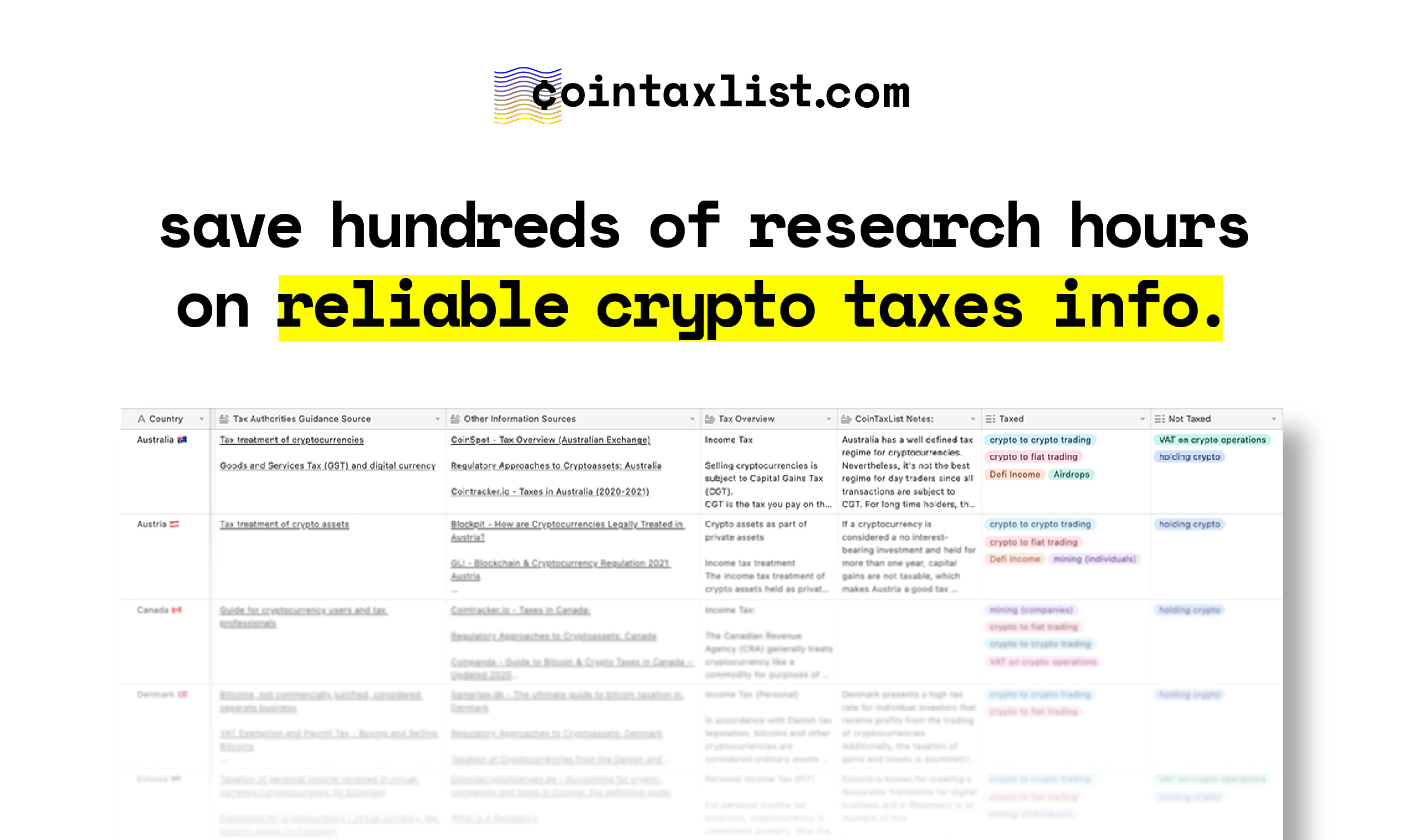

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

👉 Get access to the database here. 👈