Bitcoin was initially created with the purpose of being a purely peer-to-peer version of electronic cash that would allow online payments, nevertheless, cryptocurrencies payments are still in a development stage.

In the last few years more and more technological solutions that simplify the life of vendors that want to accept crypto payments were introduced.

As a result, more vendors are accepting crypto as a payment method and crypto ATM networks are increasing every year. Mass adoption of crypto is getting closer, but, at this stage, the question still poses: what can you buy with cryptocurrencies in 2021?

🏠 Can I buy a house with crypto?

The answer is yes. Buy luxury properties around the world not only with Bitcoin but also Ethereum, Cardano, Ripple or DogeCoin.

You can buy a caravan in this US online retailer, if you want a home on wheels.

At Overstock you can also shop all things furniture with crypto once you close your new home.

🍔 Can I spend crypto on food?

Well, yes but mostly fast food. Fast food chains are getting into crypto to attract customers or to get some buzz like Burger King, Coca-Cola, Subway, Domino’s Pizza or Starbucks, but be aware that it may not be available in the country you live in.

🚘 Can I buy a car with Bitcoin?

Tesla no longer accepts Bitcoin, till further notice. But you can always buy a BMW with Bitcoin at this UK car dealer.

Or you can always Lambo to the Moon on a real Lamborghini.

🚀 Can I use crypto to travel?

CheapAir accepts 10 different coins for you to spend on your flights.

Find a hotel room from 700k+ Expedia Hotels via travel booking platform Travala. It accepts BTC, BCH, ETH, BNB as a payment method.

Book a tour now that Experiences’ giant GetYourGuide accepts DogeCoin in the US.

All space travels expenses can be paid in Bitcoin at Virgin Galactic.

Find a Bitcoin ATM when traveling with this interactive map when you need to convert to FIAT;

Binance users can now access Hotels, the first category on the Binance Marketplace powered by Binance Pay.

💻 ⚽ Other stuff you can spend your crypto on

Microsoft lets you use BTC to shop at their Windows and Xbox stores.

You can use 50+ different coins to make Twitch donations.

Both Etsy and Shopify allow any seller or store on their platforms to be paid in cryptocurrencies.

Football (soccer) club Benfica accepts Bitcoin to pay for tickets. Or use crypto to buy NBA tickets from the Sacramento Kings or the Dallas Mavericks

🎗️ Charities that accept crypto donations

If you’re looking for a worthy cause to donate your crypto, Wikipedia, Save the Children or The Water Project accept crypto as a donation.

The Giving Block has a nice tool to filter through the countless nonprofits accepting cryptocurrencies.

You can also donate crypto with GiveCrypto, a nonprofit that distributes cryptocurrency to people living in poverty.

🧾 Can I pay my taxes with crypto?

Individuals and companies who are liable to tax in the Canton of Zug in Switzerland are able to pay their tax invoices with the cryptocurrencies Bitcoin and Ethereum.

El Salvador introduced Bitcoin as a legal tender and will make it possible to pay taxes with Bitcoin

But don't forget, if you buy something with crypto, it is probably a good idea to buy back part of the crypto you spent, so that you don't end up like the Bitcoin Pizza Guy.

What’s the tax impact of paying with cryptocurrencies?

As an example, in the US paying with cryptocurrencies is considered a taxable event which means that a payment will give rise to capital gain or loss.

In fact, according to the IRS, “if you pay for a service using virtual currency that you hold as a capital asset, then you have exchanged a capital asset for that service and will have a capital gain or loss”.

In this context, you should be aware of this fact so that you don’t inadvertently increase your tax burden while doing payments with cryptocurrencies. You could also combine a tax loss harvesting strategy with payments made with crypto, to make it more efficient from a tax perspective.

In regards to donations to charities, donating your crypto is tax free and deductible as long as you are donating to an IRS-recognized tax-exempt charity. The amount of your donation that is tax deductible (between 30% and 50%) depends on how long you have held the assets.

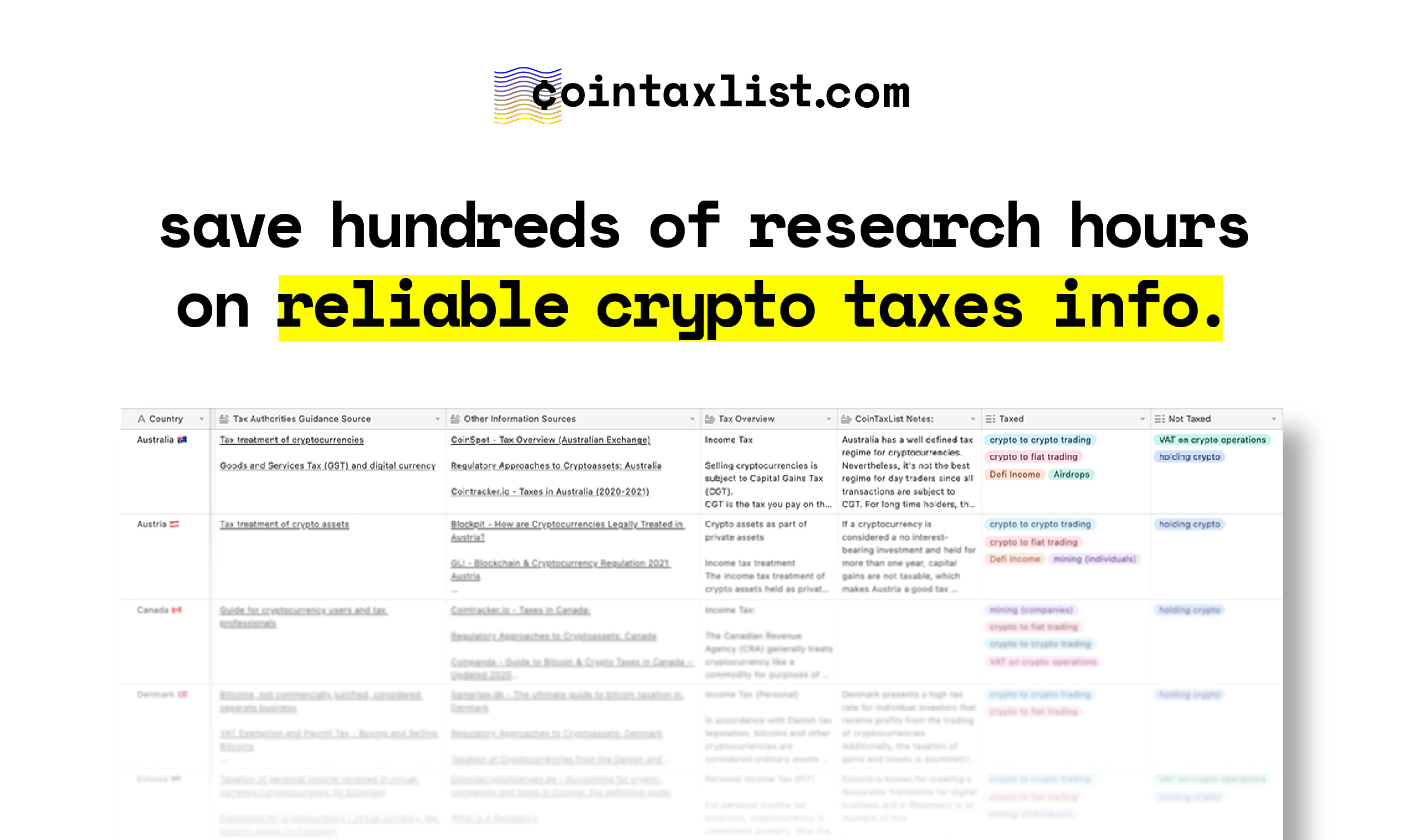

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.