In this article we discuss the possibility of using a company in Estonia to perform crypto investments (trading or mining) and its tax advantages if correctly structured.

First of all, if you are thinking about restructuring your crypto investments or start investing in crypto, a structure as the one described here has, naturally, set up and running costs, that would only make it attractive if your recurring crypto profits are above a certain threshold.

What's so special about Estonia Corporate Taxes?

Estonia corporate tax system is different from most in the world since Estonian companies pay corporate taxes only if and when they distribute dividends.

This means that the profits reinvested by the company to finance its business operations aren’t taxed.

In this sense, in principle, any income deriving from cryptocurrencies (trading, mining, and others), should only be subject to CIT once the profits are distributed to the shareholders.

The CIT rate in Estonia is generally a flat 20% (can be reduced to 14% in certain situations), calculated as 20/80 from taxable net payment.

In this case (when there isn't any dividend distribution), the corporate profits are exempt from CIT. This exemption covers both active income (such as incomes earned from trading) and passive income (profits derived from dividends, interest, royalties, and so on).

This tax regime may be interesting for crypto investments (trading, mining or other) as long as profits are reinvested since it reduces the annual tax leakage (as long as you don't distribute dividends).

The compound of effect of not having taxation over your profits every year can allow a high amount of tax savings and a lower effective tax rate.

Additionally, you don't have to worry about sell some investments at a loss to offset gains you’ve realised in order to pay less taxes (tax loss harvesting) or how crypto to crypto transactions may give rise to taxable gains.

I opened a company in Estonia. Now what?

Since the profits from this company would be paid to you as an individual in the form of dividends, you should look for a jurisdiction that presents low Personal Income Taxes regarding income from dividends.

There is a number of countries that you could choose (or even the country that you are currently a tax resident) but in this example structure we will focus in a country normally referred as a crypto tax friendly country: Portugal.

If you have read one of our previous blog posts about crypto taxes in Portugal, you should know that the Portuguese Tax Authorities considers that income resulting from the sale of cryptocurrencies is not subject to Personal Income Tax unless it is considered that this activity is a professional or entrepreneurial activity of the taxpayer.

Nevertheless, this does not mean that the Portuguese government will not, or is even pressured, to introduce a law that would would eventually tax crypto for individuals.

In this case, we purpose a more stable long term investment strategy that has low tax leakage and is entirely based in the European Union and without using tax havens.

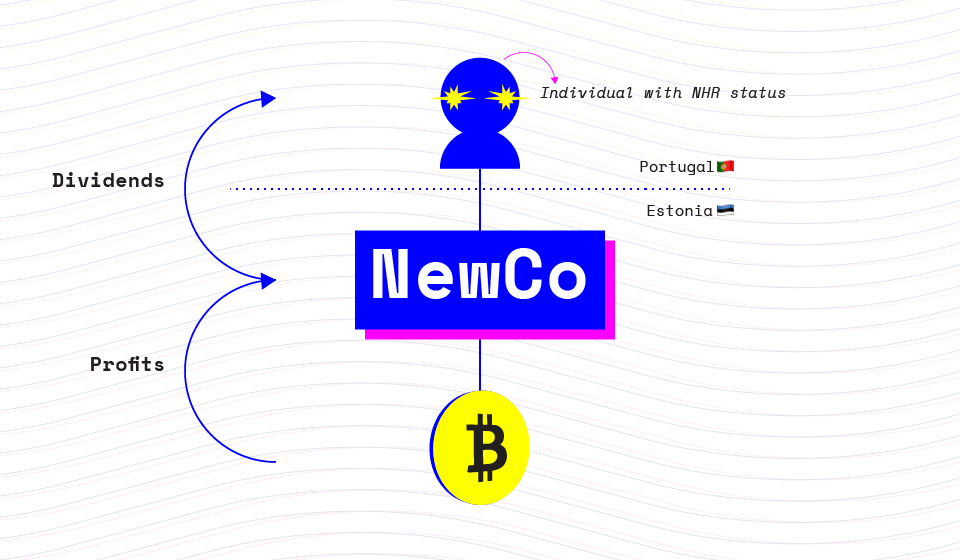

In this structure, instead of holding your crypto directly in Portugal (at an individual level), you would hold your crypto investments through an Estonian company.

Additionally, you would apply for Non-Habitual Resident regime (NHR) in Portugal.

Once you benefit from NHR status in Portugal, most foreign source income is exempt from Portuguese income tax for ten consecutive years, as well as income taxable in another country.

This means that foreign source dividends, interest, capital gains and rental income, together with self-employment and professional income (in this case, only if derived from high value added activities), can be exempt from PIT in Portugal using the NHR regime.

Income from employment and self-employment can be liable to a special 20% flat rate if derived from high value added activities of scientific, artistic or technical character performed in Portugal.

Please note that Portugal, like almost all other OECD countries, enforces effective management rules, which means that if the Estonian company is being managed from Portugal, it may be considered that your activities create a permanent establishment there and give rise to taxation in Portugal. For this reason, you should take this into consideration while structuring the operation to guarantee that you are not violating any tax avoidance law and attracting the taxation back to Portugal.

In short, if you relocate to Portugal, benefit from NHR status and invest in crypto using a company in Estonia, you could benefit of a very low tax rate for your crypto investments (as long as you don't distribute the profits the company in Estonia generates every year and reinvest them).

How to qualify for NHR Status?

To qualify to NHR status, an individual must meet the following requirements:

- Become tax resident under Portuguese domestic legislation; and

- Not having been taxed as a Portuguese resident in the five years prior to taking up residence in Portugal.

An individual is considered a tax resident in Portugal for any year in which:

- He/she stays in Portugal for more than 183 days (continuously or not) during a 12 month period, which begins or ends in that tax year; or

- He/she has a residential accommodation available in Portugal in any day of that 12 month period, which is used as the individual’s habitual abode.

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

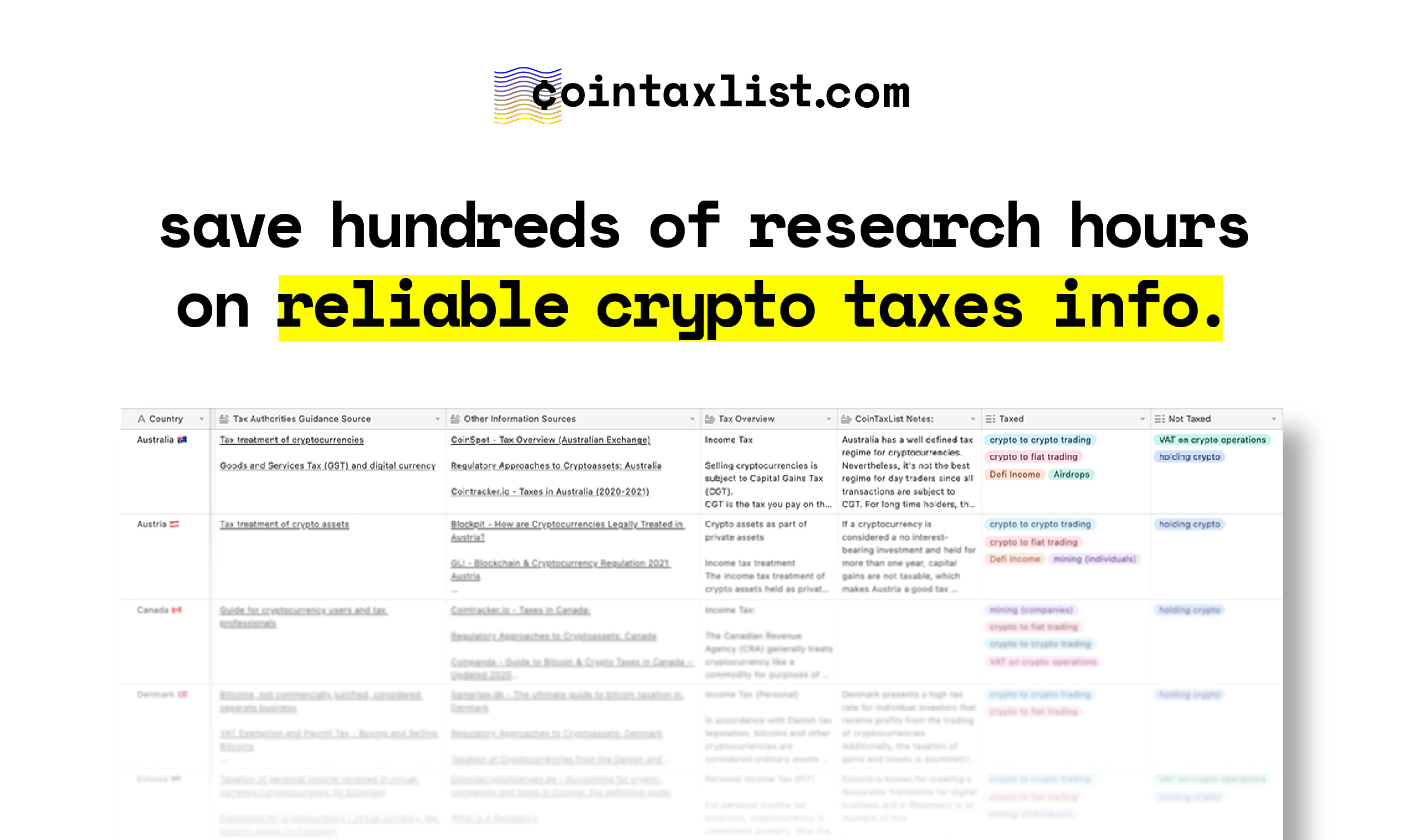

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.