Portugal is becoming one of the most popular destinations for crypto community to relocate, enjoy the sun and live off crypto gains.

In this article we cover various aspects that are valued for people that are considering making this move.

Portugal Crypto Taxes

There are several reasons for Portugal to be considered a crypto friendly country, but one of the most important is the perception that Portugal is a crypto tax friendly country.

In short, since Portuguese Tax Law doesn't foresee crypto taxes as for now, the Portuguese Tax Authorities consider that capital gains resulting from the sale of cryptocurrencies are not subject to Personal Income Tax unless it is considered that this activity is a professional or entrepreneurial activity of the taxpayer.

Although, the current tax framework can be beneficial for individuals, there are nuances that you should be aware of regarding crypto taxes, that we already covered in a past article.

Non-Habitual Resident (NHR) Tax Regime

NHR is a special tax regime for new residents (that have not lived in Portugal in any of the last five tax years) that allows pensioners, high net worth individuals and entrepreneurs to benefit from an attractive tax regime.

To benefit from the NHR you have to be considered a resident, for tax purposes, in the Portuguese territory, which happens when you have remained in the territory for more than 183 days, consecutive or with interruptions, in any 12-month period beginning or ending in the year in question.

Alternatively, if you don't meet the previously referred period, to have a house in such conditions that it is clear that the person has the intention to maintain and occupy it as an habitual residence.

Individuals covered by the NHR regime can benefit from the special Personal Income Tax (“PIT”) regime for a ten year period.

The main advantages of the NHR, which are available if certain conditions are met, are:

- Tax exemption of foreign source self-employment and professional income (in this case, only if derived from high value added activities);

- Tax exemption on foreign source dividends;

- Tax exemption on foreign source interests;

- Tax exemption on foreign source capital gains;

- Tax exemption on foreign source rental income.

This makes it a very competitive tax regime for individuals in the international landscape and naturally a factor to take into account.

Are banks crypto friendly?

Currently, none of Portuguese banks is openly and publicly crypto friendly, but that doesn't mean you can't use them or that they will block your transactions.

Especially when it comes to transactions of higher amounts, you should consider doing a meeting with the bank prior to the transaction, to understand the documental requirements necessary to prove the origin of the funds and if it will raise problems to the bank's compliance and risk management department.

On some occasions, a bank may red flag your transaction (normally for compliance reasons) and freeze your funds until you provide the information needed.

Alternatively, you may consider using a EU based bank that is more crypto friendly.

In person crypto events

With the crypto community increasing in Portugal, the country has been chosen to host a lot of events in the last few months. To give you a sense, these are the crypto related events that are taking place in Lisbon between October and November 2021.

- Lisbon Blockchain Week (Oct 18-24, 2021)

- The Daoist (Oct 19, 2021)

- Liscon (Oct 20-21, 2021)

- ETHLisbon (Oct 22-24, 2021)

- NEAR Con (Oct 26-27, 2021)

- WebSummit (Nov 1-4, 2021)

- Cosmoverse (Nov 5-6, 2021)

- Solana Breakpoint (Nov 7-10, 2021)

Friendly for remote workers

Portugal is also on the radar of remote workers and digital nomads, being one of the most popular destination for these type of workers.

If you check Nomadlist, the 4 most popular places in the world for remote workers are in Portugal (Lisbon, Madeira, Porto, Ericeira).

There are lots of factors that affect this ranking, some of them mentioned in this article, but the fact that Portugal is geographically well positioned (between the USA and Asia) makes it friendly from a timezone perspective for remote work.

Other reasons to consider:

- English speaking population - Portuguese are considered to have a very high proficiency in English.

- Safe country - Portugal is considered one of the most peaceful countries in the world, with low crime rates.

- High COVID-19 vaccination rate - More than 86% of Portuguese are fully vaccinated against Covid-19, making it one of the countries with highest vaccination rate worldwide.

- Relatively low cost of living - Although in the last years real estate costs have increased, Portugal still is a country with a relatively low cost of living in the European Union context.

- Good weather - Portugal is one of the countries in Europe with more sunshine hours per year.

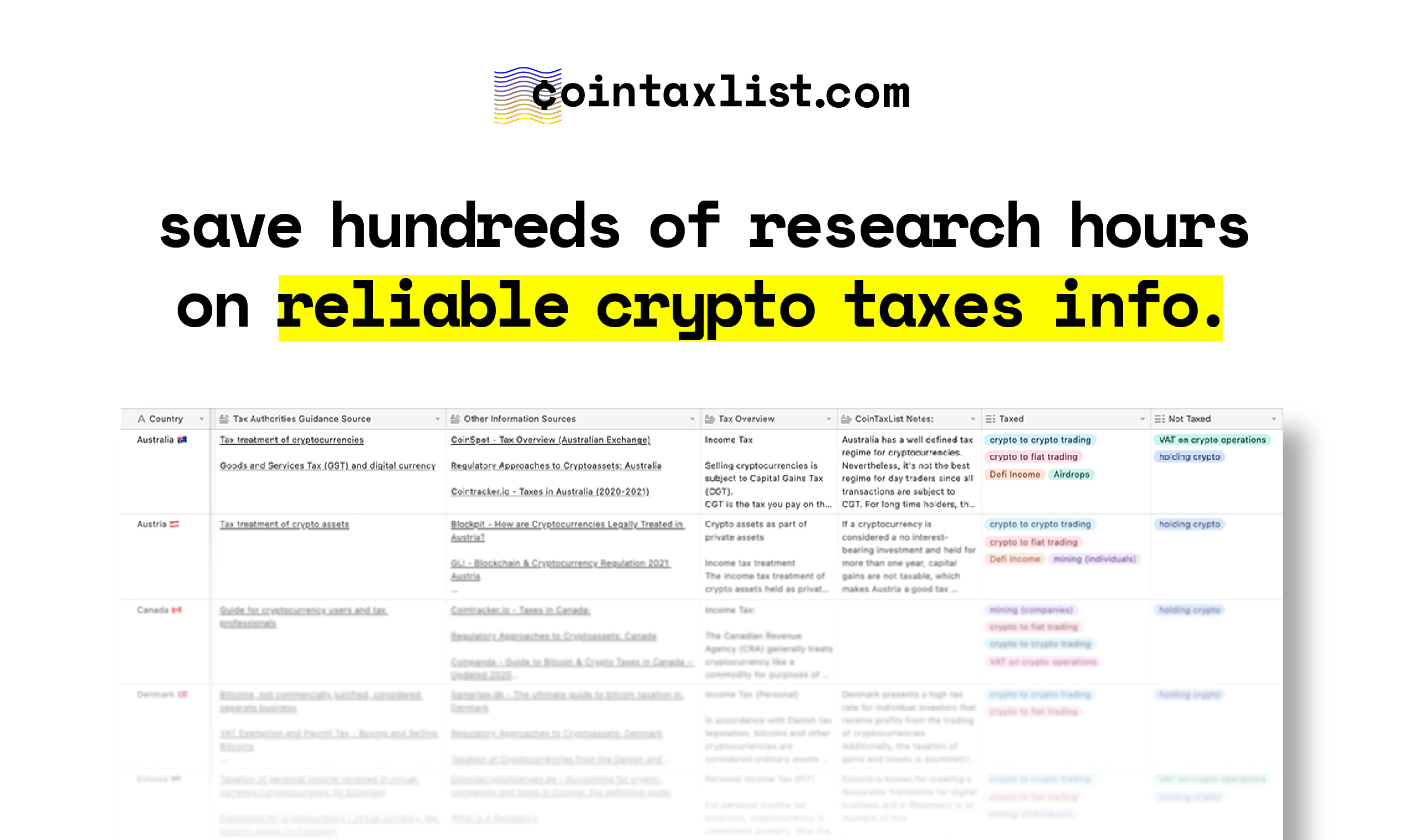

This post is brought to you by CoinTaxList, which focuses on crypto tax research and knowledge.

What is CoinTaxList Database?

CoinTaxList researched and created a database with an overview of the crypto taxes of 30 countries.

What’s included in this database:

👍 Crypto Tax Overview of 30 countries

👍 Existing Tax Authorities Official Guidance

👍 Tax Authorities Official Sources Links

👍 Tax overview of income related to crypto (e.g: on trading, mining or ICOs)

👉 Get access to CoinTaxList database here. 👈

Reasons to get CoinTaxList Database:

👉 This database focuses solely on crypto tax. We made this database for people who are into, hold or deal with crypto assets. If you don’t meet the description, don’t buy this product.

👉 Instant access to reliable crypto tax info. We want you to save time and reach relevant crypto tax info for your particular case, fast and easy.

👉 Pay ONCE and have free updates on all new added countries. We will let you know every time we add a new country and won’t charge you anything else for it.

Countries listed on the database: Andorra, Argentina, Australia, Austria, Canada, Denmark, Estonia, Finland, France, Germany, Gibraltar, Hong Kong, Ireland, Israel, Italy, Japan, Jersey, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Portugal, Singapore, South Africa, Spain, Switzerland, UK, Ukraine, USA.

👉 Get access to the database here. 👈

Disclaimer: The information provided in this blog post is for general information purposes only. The information was completed to the best of our knowledge and does not claim either correctness or accuracy. For detailed information on crypto taxes, we recommend contacting a specialist in the specific country.